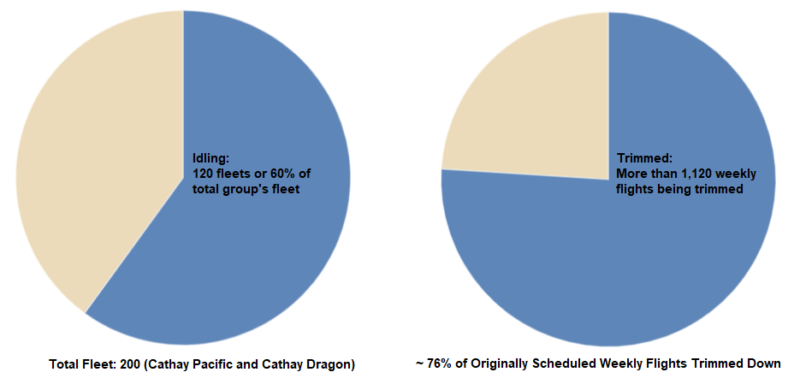

COVID-19: CATHAY PACIFIC HAS 120 AIRCRAFT

GROUNDED According to SCMP, Cathay Pacific and Cathay Dragon have 120 aircraft idling on the ground at any given time; which accounts for more than half of their fleet. In addition, the group has cut more than three-quarters of their weekly flights in March. Around 1,470 weekly flights were originally scheduled for this month, but it is now been trimmed down by more than 1,120 flights.  Data source: SCMP Back in 2003, during the SARS crisis, Cathay trimmed 45% of their scheduled flights and had around 30% of their fleet idling on the ground. Comparing these two epidemics, it appears that Convid-19 is bringing a greater impact to the airline. SCMP video showing dozen of aircraft idling at Hong Kong International Airport In the past couple of weeks, Cathay Pacific has asked 27,000 employees to take 3 weeks unpaid leave; they have also temporarily closed three of their premium lounges at Hong Kong International Airport. Explaining the situation, an analyst from Bocom International, Luya You, said that "an outbreak is the kind of macro impact that is really hard for an airline to plan around... during an outbreak, all of it collapses because people, no matter the price point, are no longer willing to fly". Singapore Airlines, one of Cathay's closest rival, has temporarily suspended over 3,000 flights, from February until the end of May. In addition, the management team is taking a 15% pay cut; they will also be offering a voluntary no-pay leave scheme to employees. |

| Travelers are paying thousands of dollars to evacuate from

coronavirus-affected areas on private jets. Thanks to aviation loopholes, they

can get out quickly despite travel bans. Private jet travel companies have reported surges in demand in response to the coronavirus outbreak. Shutterstock/IM_Photo

"In short, we are booming," Justin Crabbe, CEO of private jet charter company Jettly, told Business Insider. "I've never seen so much activity in our evacuation flight department." Jettly, which has headquarters in New York and Toronto, connects clients to 23,713 private aircraft around the world and calls itself the "Expedia of private aviation." The company has seen an unprecedented spike - thousands of requests "within hours" - in last-minute travel and evacuation requests from clients trying to avoid existing and impending travel bans. "This time of year we typically see 2,000 to 3,000 flights requested each day, but we have doubled that for almost every news release of a major outbreak in the past weeks getting people out of the affected areas," Crabbe said. To accommodate the demand, Jettly is tripling its flight support staff. Adam Twidell, CEO of London-based PrivateFly, told Business Insider that his company has also seen a rise in demand for short-notice charter over the past few weeks related to the coronavirus. "We've had a very significant number of inquiries for group evacuations and from corporates and individuals," he said. The coronavirus, which originated in Wuhan, China, has since spread to at least 69 countries and infected over 89,000 people. Over 74 commercial airlines have canceled flights around the world as a result of the outbreak, which the International Air Transport Association estimates will cost the global airline industry close to $30 billion in 2020. Reporting for the Financial Times, Tanya Powley noted that the number of business jet flights from Hong Kong - a destination close to the outbreak's epicenter - to North America and Australia was up 214 percent year-over-year in January, and the number of flights from Hong Kong to locations around the globe was up 34.2 percent-year-over year. Events such as the Superbowl have created demand spikes in the past, Crabbe noted, but these requests usually come weeks in advance of the events. The coronavirus-related demand is unlike anything Crabbe has seen. "It's very unusual to see the sporadic and immediate demand we see as a result of this coronavirus outbreak." Media reports of the coronavirus outbreaks and travel bans have fueled demand - and clients are willing to pay top dollar for last-minute flights Demand has been driven by media, Crabbe noted. Reports of travel bans, city quarantines, evacuations, and new cases "drive the public to become extremely fearful and prefer to stay away from commercial airport terminals and commercial aircraft cabins due to the increased levels of exposure," he said. PrivateFly's coronavirus-related flights have ranged from the transport of medical teams to new clients wishing to avoid exposure that a commercial flight might bring. "Recent inquiries have included transport of a decontamination team within Asia, and flights from Hong Kong for a family traveling to Bali. They normally fly by commercial airline but on this occasion, are concerned about exposure on the flight," Twidell told Business Insider. Jettly customers, both individual and corporate, are willing to pay well above standard rates - a typical rate for a light jet that seats six to eights passengers is $5,000 for an hour - to evacuate areas within 24-48 hours instead of waiting a few days. "We have seen dozens of bookings that are two to three times the regular rate for the flight due to the increased demand and the shortage of available aircraft and crews in the area," Crabbe said. "Many aircraft are having to fly in to pick up customers and evacuate them. All of that additional flight time comes with additional cost." Large companies, in particular, are spending top dollar. "Some of our large corporate clients have already activated their disaster relief plans which include the evacuation of employees out of affected areas back home to the United States and there appears to be no limit to what some of them will spend," he said. Private jets can capitalize on "many holes" in the system to avoid travel bans and other coronavirus-related regulations Private jets have more flexibility when it comes to flying in and out of areas affected by coronavirus than commercial planes, according to Crabbe. "In my opinion, there are many holes that are being left open," he said. "Passengers are using private terminals off to the side of the regular commercial terminals and are not subject to commercial security, possibly even including temperature screenings," he said. GlobeAir, a Europe-based private jet charter company, has set up a coronavirus advisory page on its website, noting that private jet charters and lounges are "much more secure than big airports' terminals" for travelers looking to avoid coronavirus exposure. However, the company encourages clients and staff to follow preventative health measures. The company states that "instructions to report the state of health to the authorities are known" to its staff. The long-term effects of the coronavirus outbreak on the private aviation industry are yet to be determined While private air travel is surging, the long-term effect of the coronavirus outbreak remains to be seen. "Any short-term gain is obviously balanced with longer-term concerns and challenges, including the impact on the global economy," Twidell told Business Insider. "Even now, while we're seeing short-term additional demand, other clients are changing or canceling their travel plans," he said. "And obviously the operational logistics of flying in or out of China, and increasingly between other countries, is now highly complex, with low availability of aircraft and crews making it difficult to fulfill requests. Operational protocols are changing daily - it's a very fluid situation, which we are monitoring closely." What's more, "some pilots and air operators are no longer willing to fly into red zones such as Iran for fear of putting themselves or their families at risk of infection through a passenger onboard," Crabbe said. |

Emirates airline asks staff to take one month unpaid leave

over coronavirus FILE PHOTO: Emirates Airline Boeing 777-200LR lands at Mexico City International Airport during its first route from Dubai via Barcelona to Mexico City DUBAI (Reuters) - Major international airline Emirates is asking staff to take unpaid leave for up to a month at a time due to the rapidly spreading coronavirus that has led to flight cancellations around the world. Emirates has canceled flights to Iran, Bahrain and to most of China because of the virus, and countries around the world have placed strict restrictions on entry of foreigners. The airline has more resources than it needs as a result of cutting frequencies or cancelling flights to some destinations, said Chief Operating Officer Adel al-Redha in a statement on Tuesday. "Considering the availability of additional resources and the fact that many employees want to utilize their leave, we have provided our employees the option to avail leave or apply for voluntary unpaid leave for up to one month at a time," he said. Emirates Group, the state-owned holding company that counts the airline among its assets, has asked staff to consider taking paid and unpaid leave as it seeks to manage a "measurable slowdown" in its business, Reuters reported on Sunday, citing an internal company email. The group had more than 100,000 employees, including more than 21,000 cabin crew and 4,000 pilots, at the end of March 2019, the end of its last financial year. Major concerts and events in the United Arab Emirates, an air transit center that includes tourism and business hub Dubai, have been canceled or postponed as the coronavirus spreads in the Gulf. The airline industry's largest global body IATA on Monday urged Middle Eastern governments to provide support to airlines as they try to manage the impact of the outbreak. |

SAS pulls full-year financial guidance amid

coronavirus uncertainty

By Graham Dunn3 March 2020

Scandinavian

carrier SAS has withdrawn its full-year financial guidance as a result of

uncertainty around the impact on air travel demand of the coronavirus outbreak.

Amid a recent

spike in coronavirus cases reported in Europe, the Star Alliance carrier has

disclosed plans to reduce part of its short-haul capacity over the next two

months to counter lower demand. The carrier had already suspended flights to

mainland China in response to the outbreak and will now suspend Hong Kong

services from 5 March.

Fornebu Airport, Oslo Anno 1960 - Source: SAS

SAS now plans to

reduce short-haul capacity over the coming months

”In order to

mitigate the revenue impact from the reduced demand, SAS is pursuing a number

of cost reduction initiatives,” the airline says a stock market update today.

Alongside

cost-savings from the reduced capacity, it is also implementing other measures

such as cuts in administration, a hiring freeze and the postponement of

non-critical projects. ”Measures related to personnel expenses may include

temporary lay-offs, voluntary leave, early retirement or other initiatives,” it

says.

In its initial

initial guidance for its financial year ending October 2020, SAS said it

expected to deliver an EBIT margin before items affecting comparability of

3-5%. While it retained this guidance as recently as when releasing its first

quarter results on 26 February, that was subject to a limited impact from

coronavirus .

”Given the

uncertainty surrounding the outbreak and its impact on overall demand for air

travel, SAS withdraws its fiscal year 2020 guidance provided to the market on 5

December 2019,” SAS says today.

”At this stage, it is too early to

assess the full impact on SAS operations and financial outcome and therefore

not possible to give a more accurate guidance.”

Ingen kommentarer:

Legg inn en kommentar

Merk: Bare medlemmer av denne bloggen kan legge inn en kommentar.