[Analysis] PLAY is well positioned to shake up Icelandic low-cost airline market, says GlobalData

The recent announcement of Iceland’s new low-cost carrier (LCC), PLAY, reaffirms that now is the perfect time to launch an LCC. With the airline’s carefully considered leisure route network, PLAY has many fruitful opportunities to thrive, says GlobalData, a leading data and analytics company.

Gus Gardner, Associate Travel and Tourism Analyst at GlobalData, comments: “PLAY has timed its launch well. With borders beginning to reopen and travellers desperate to escape, the airline will have plenty of opportunities to capitalize on pent-up market demand. The low-cost model is well suited to serve those who may have felt a financial bite from the pandemic, and the carrier will attract those looking for cheaper travel options.”

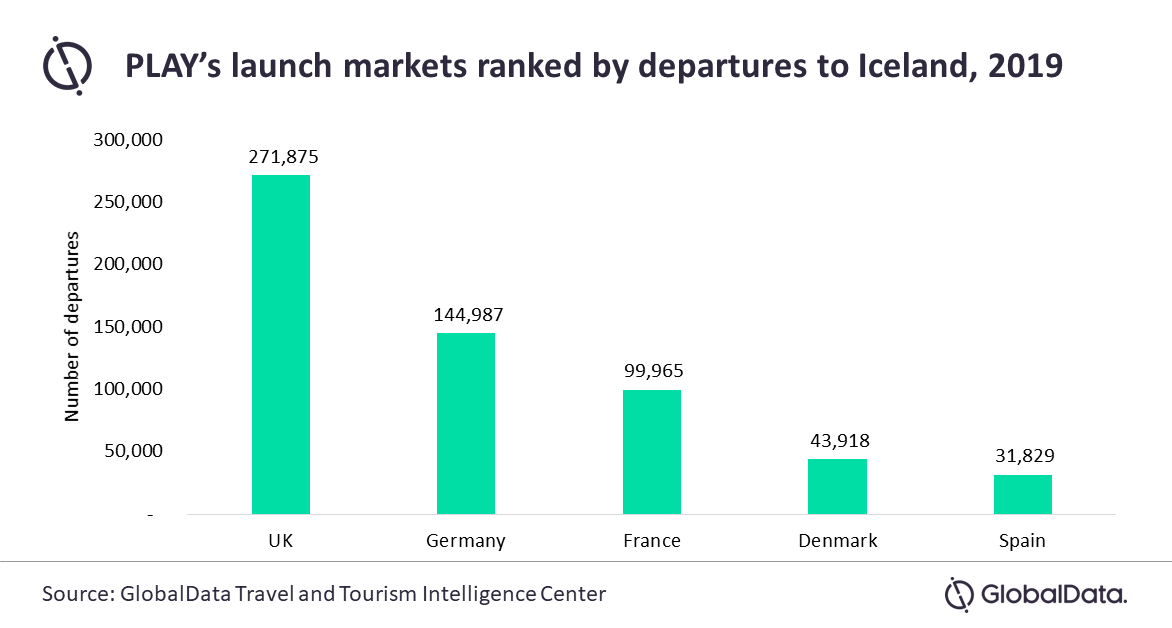

According to GlobalData, the five countries* in which PLAY is set to launch are all in the top 14 source markets by number of arrivals into Iceland.

Gardner continues: “PLAY pursuing inbound leisure travellers is a carefully considered strategy. The UK was the second-largest inbound market to Iceland in 2019 with 271,875 arrivals, according to GlobalData. With Iceland now on the UK’s green list, launching flights to the UK first could catalyze success for PLAY. As the European vaccination program gathers pace, outbound leisure travel will begin to return, and PLAY is well positioned to capture the high levels of pent-up demand that will emerge.”

However, Gardner warns that PLAY must remain cautious with its network expansion plans.

Gardner says: “Although the planned addition of US connectivity will significantly boost revenue, expanding too quickly was WOW’s flaw, and this contributed to its failure. Calculated risks must be taken, but the airline must first focus on its core competency of providing direct connectivity to Iceland.”

GlobalData notes that PLAY will be at a notable disadvantage to its competitors, as it has equipped its A321neo aircraft with only 192 seats compared to easyJet’s 235 and Wizz Air’s 239.

Gardner adds: “A lower seating density goes against the grain of an LCC and could hinder PLAY’s ability to become profitable. LCCs work on slim margins, and with fewer seats available PLAY will have a higher cost per seat, pushing up the breakeven point. PLAY will need to fill a higher percentage of seats than its competitors to ensure profitable flying. Further, PLAY may be faced with charging higher fares, which goes against the grain of a LCC and puts even more pressure on achieving a high load factor.

“PLAY may seem like ‘WOW Mark II’, however, with a well-thought-out network and the demand for low-cost flights rising, the airline will be in a strong position for success as cost-consciousness takes on even greater significance. Responsiveness and smart decision making will be critical, and capturing high levels of pent-up demand will be crucial.”

* The UK, Spain, France, Denmark and Germany

Ingen kommentarer:

Legg inn en kommentar

Merk: Bare medlemmer av denne bloggen kan legge inn en kommentar.